U.S. employers are leaving no stones un-turned when seeking ways to keep health care costs down for themselves and their workers.

U.S. employers are leaving no stones un-turned when seeking ways to keep health care costs down for themselves and their workers.

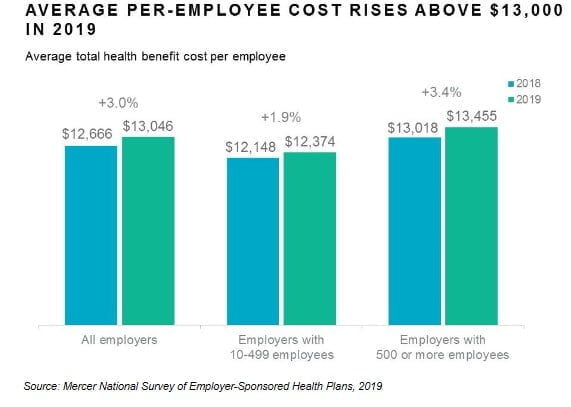

The 2019 Mercer National Survey of Employer-Sponsored Health Plans found health benefit costs nationally will top $13,000 per employee this year. The average total health benefit cost per employee grew 3.0% to reach $13,046, following a rise of 3.6% in 2018, according to the survey by New York-based Mercer.

This is the eighth consecutive year of health benefit cost growth in single digits, and employers expect cost to rise at a similar pace next year, the Mercer survey found. Still, cost increases continue to outpace overall inflation and health benefit cost management remains an imperative for most organizations.

As employers look for cost-management strategies to keep from shifting costs to employees, many businesses are turning to tech-enabled programs to help employees manage chronic conditions or other health needs. In 2019, 58% of all large and midsize employers, and 78% of those with 20,000 or more employees, offer one or more of such targeted health solutions.

“Typically the goals of these programs are empowerment, convenience and lower costs,” said Tracy Watts, Mercer’s national leader for US health policy. “For example, a physical therapy app that reminds patients when to do prescribed exercises, provides instructions, and even counts reps could mean fewer trips to a clinic, less out-of-pocket cost for the employee, and a better outcome.”

Diverse workforce needs are increasingly shaping health program design. When asked about their priorities for the next five years, 42% of large and midsize employers (500 or more employees) identified “addressing healthcare affordability for low-paid employees” as an important or very important strategy.

The survey found larger employers that had offered a high-deductible plan with a Health Savings Account as the only medical plan reversed course and added a traditional PPO or Health Maintenance Organization as an option. This trend was especially notable among employers with 20,000 or more employees: those offering only a high-deductible account-based plan fell from 22% to 16%.

“This doesn't mean HSA plans are going away, but to meet the various needs and budgets of today’s five-generation workforce, employers are increasingly offering an array of health benefit plans,” Watts said. “In fact, many employees who do the math at open enrollment find an HSA is a smart financial move. But for those with little savings or significant health issues, another plan might be a better fit.”