Homeowners’ tax bills expected to go up 15% this year

Property owners could get temporary tax relief under a top Indiana lawmaker’s bill that seeks to stymie the impacts of high assessments last spring.

A new study projects homeowners’ bills payable this year could increase as much as 15%. That’s more than double what previous reports estimated for the upcoming bills.

Rep. Jeff Thompson, R-Lizton, filed legislation that would temporarily provide a supplemental homestead credit and lower the 1% cap on residential property taxes. He chairs the House Ways and Means Committee, meaning the bill could get more traction.

Multiple other property tax measures are also floating around the General Assembly.

While it could mean relief for property owners, schools are expected to take on the brunt of the tax burden if Thompson’s policy change takes effect.

Between 2024 and 2027 — during which property owners would pay reduced taxes — school corporations are estimated to lose more than $364 million in revenue.

That’s significantly more than cities, towns, counties and other units that are also expected to see decreased revenues.

“We’ll look at all that, because some will shift, and some will decrease,” Thompson said about tax burden responsibility. “We’ve got both options, maybe a marriage of both. I don’t know, we’ll see.”

Taxpayer savings in Thompson’s bill

Thompson’s legislation would temporarily reduce the homestead tax cap for taxes payable in 2024 and gradually increase the cap back to 1% in 2028.

Caps would be set at 0.9% for property taxes payable in 2024, 0.925% in 2025, 0.95% in 2026 and 0.975% in 2027.

The bill also creates a supplemental homestead credit to be applied to tax bills after all other credits are applied. The added credit for each homestead would be equal to $100 in 2024, $75 in 2025, $50 in 2026, and $25 in 2027. The credit is not allowed to exceed what a taxpayer owes, however.

The Indiana Constitution states that property tax liability “may not exceed” the 1-2-3% caps, giving lawmakers an ability to establish the lower caps.

The reduced property tax bills for homeowners is estimated to result in $357 million in tax relief in 2024, according to Indiana’s Legislative Services Agency. The tax savings for homesteads is then estimated to drop to $275 million in 2025, $183.4 million in 2026, and $136 million in 2027.

Taxable assessed values shot up 15% from 2021 to 2022 — even after tax abatements, deductions and credits — according to data from the Association of Indiana Counties (AIC). That’s compared to a 5% increase the year before, and increases under 5% in each year since at least 2014.

A new study from the nonprofit organization paints a daunting picture for taxpayers, though.

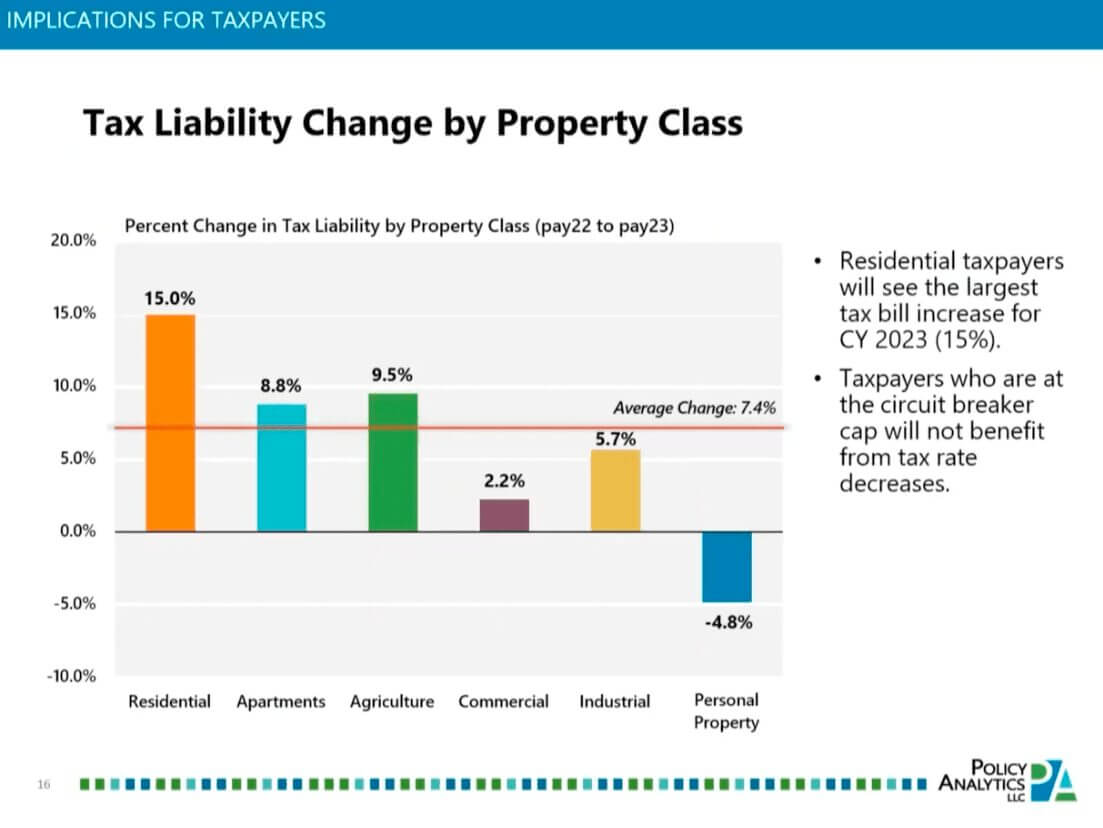

Although the average tax increase for all property owners is expected to go up by 7.4%, on average, residential property owners specifically are estimated to see a 15% increase in tax liability, according to an AIC study conducted with Indianapolis-based economic research firm Policy Analytics.

Increases will mostly be dependent on what type of property a taxpayer owns and whether they’re already at the circuit breaker cap.

Homeowners are projected to see the largest increases due to 2022’s higher assessments, and because net assessed values rise faster than gross assessed values according to the study. The fixed standard homestead deduction is what largely contributes to the inflated bills for residential property, but not to other property types.

AIC Executive Director David Bottorff said the group advocates for new policy that would affect taxes in 2024, but not anything that would be retroactive for 2023 property owner bills due in May.

David Ober, vice president of taxation and public finance for the Indiana Chamber of Commerce, said that while much of the conversation at the Statehouse is currently focused on residential property bills, caps for those taxpayers would have “far reaching implications” for business entities.

“It remains to be seen what may happen, but shifting the cost of local government to (businesses) is something that we’re very much concerned about,” he said.

Commercial property taxes are estimated to increase by 2.2% in 2023, and industrial property tax are expected to go up 5.7%, according to the AIC study. Businesses with large amounts of equipment are likely to see the smallest tax liability increases, however.

Where lawmakers stand

A range of other bills filed by lawmakers include those that seek to eliminate or limit annual market-based adjustments, freeze property taxes for certain homeowners and allow local governments to recover lost revenue.

It’s not clear where lawmakers stand on particular bills, or whether there’s enough support to take any action at all on property taxes in the current legislative session.

House Speaker Todd Huston, R-Fishers, said there’s still “a lot of uncertainty around property taxes right now” and emphasized that “our constituents are very concerned about what their property tax bills are going to look like.”

Huston did not comment specifically on the proposal to cap property taxes, and the GOP majority in the Senate isn’t so sure about taking any action to address property taxes during this session.

Republican Senate Pro Tem Rodric Bray said if Thompson’s bill advances to the Senate “then we’ll certainly talk about it,” but he didn’t know whether the proposal would have enough caucus support.

“The challenge with doing anything right now would be that anything that we do would not be able to impact the property tax bills that people are going to get in March, it would be doing something a bit after the fact, which may not be as effective as we would all want,” Bray said Thursday.

He said his chamber is more so focused on a Senate GOP priority bill that seeks to form the State and Local Tax Review Commission to study the feasibility of ending Indiana’s income tax and reforming property taxes for Hoosiers.

Still, if a property tax measure can make it through both chambers, Indiana Gov. Eric Holcomb suggested he would be willing to give the greenlight.

“I wouldn’t be surprised if we do something during the course of this session,” Holcomb said Thursday. “We’re going to get at the root causes of the increases that are occurring. We’re in close conversation with the House and the Senate leadership and members on having the ability to do something that doesn’t change, fundamentally, the advancements we’ve made.”

This story originally appeared on the Indiana Capital Chronicle website. The organization is part of States Newsroom, a network of news bureaus supported by grants and a coalition of donors as a 501c(3) public charity. Indiana Capital Chronicle maintains editorial independence. Follow Indiana Capital Chronicle on Facebook and Twitter.